Teleworking Related to COVID-19

While guidance continues to evolve in response to COVID-19 in Maine, we understand agencies have many questions regarding document processing. To the extent possible, we have authorized OSC employees to telework, while continuing to strive to serve agencies with minimal disruption. We will continue to process paper-based transactions; however, there may be some delay in the turnaround time for those items. To the extent possible, we would like to reduce paper-based processing and rely on alternative, electronic transmission of documentation and approvals. Toward this goal, we are asking that agencies limit processing to the highest priority items and communicate with OSC via email, through OSCAccountingStaff@maine.gov for all urgent, paper-based transactions.

Following is some important information that we can share with you at this time, in the form of Frequently Asked Questions. If there are additional questions, please feel free to email Shirley.browne@maine.gov for policy-related questions and OSCAccountingStaff@maine.gov for accounting-related transaction processing.

- Will the Advantage system be available?

- Will interfaces continue to be processed?

- Will journals be reviewed for approval?

- Will payments over $10000 that require OSC approval be processed?

- Can we change a payment document status to 98 to accelerate the processing timeline?

- Can OSC review electronically, if paper documents cannot be delivered?

- What approvals will be accepted in lieu of a wet signature?

- What are the critical components to include in emails for payment documents and supporting approvals?

- What if the support documentation includes PII (SSN, DOB, Confidential settlement information, etc.)?

- How will documents be scanned to DocuWare when processing and approvals are supported by emails?

- Can agencies request TR Pick up?

Documents

- What is the format of a Document ID?

- How do I fix an invalid Document ID that hasn't been finalized yet?

- How do I recall a Document from the worklist?

Payments

- What does a TR pickup mean?

- What do the "98" and "99" codes mean?

- What does priority payment processing mean?

- What is the normal processing time for payment documents?

- When do checks and EFT payments process?

- If my payment document says "Final", why didn't my payment process?

- What should be written on invoice(s) and included in a payment document?

- Do I need original signatures?

- Editing or Canceling a payment document?

- How do I create a modification to a processed payment document?

- When do I cancel a processed payment document?

- How should Freedom of Information Act (FOIA) checks be recorded for deposit in the Accounting system?

Journals

- What is the process for overrides?

- What is considered a priority document?

- What is the normal processing time for journals?

- When are month end journals due?

- When do I process a prior year adjustment?

- What type of description do I need on a journal document?

- What type of backup do I need for a journal document?

- What journal type should I use?

- Where can I find the journal template?

Vendor/Customer

- What is the normal processing time for vendor documents?

- What is a rush vendor approval?

- What do the "VS", "VC0", "VC1" and "VC2" prefixes to vendor codes stand for?

- Who is the user "BATCH"?

- Who is the user "INTXHHS"?

- What does MCEA mean in the Alias/DBA field on the vendor table?

- How do I know if a vendor is restricted to a specific department for use?

- What does Inactive/Reviewed mean on the vendor table?

- How do I know if a vendor is on hold?

- What is a garnishment/levy?

- What agencies/departments can place a garnishment/levy?

- How do I take my account off from garnishment/levy?

- How do I set up my account to receive Direct Deposit/EFT?

- How do I receive Email Notification for my payments?

- Who do I contact about receiving remittance advices for payments from the MIHMS system?

- Are original signatures required?

- What is policy on punctuation when entering vendors into Advantage?

- How many characters are allowed for the ‘Legal Name’ and ‘Alias/DBA’ fields on the Vendor Customer table?

- What is the policy on using CAPS Lock when entering vendors into Advantage?

- What should I do if a vendor is on hold for an IRS reason, such as a TIN mismatch?

- Is it allowable to correct a Tax Identification Number (TIN) on an existing vendor code?

Teleworking Related to COVID-19

1. Will the Advantage system be available?

Yes, the Advantage system will continue to be available consistent with normal Advantage Hours of Operation - 7 a.m. to 7 p.m. Monday through Friday.

2. Will interfaces continue to be processed?

Yes, interfaces will continue to be processed according to the normal processing schedule. Technical interface partners will continue to submit files through the MoveIt server and Business interface partners will continue to enter BIEs in Advantage.

3. Will journals be reviewed for approval

Yes, both OSC and Bureau of the Budget can review and approve via Advantage and via email if needed. We ask that agencies limit processing to critical journal transactions and transmit them via email via OSCAccountingStaff@maine.gov to the extent possible. (See guidance below.) There may be some delay for paper-based processing, so we ask that agencies clearly communicate which transactions are highest priority.

4. Will payments over $10,000 that require OSC approval be processed?

Transactions processed via MainePays will be processed in accordance with our normal schedule. The processing time for paper-based transactions may be delayed; we may not be able to meet the current 3 business day turnaround. We ask that agencies limit processing to critical transactions and transmit them via email via OSCAccountingStaff@maine.gov to the extent possible. (See guidance below.) We also ask that agencies clearly communicate which transactions are highest priority.

5. Can we change a payment document status to 98 to accelerate the processing timeline?

Agencies should continue to use priority 98 in the same manner as today; we will continue to require justification to approve these requests. Increasing the use of priority 98 will only serve to delay processing overall.

6. Can OSC review electronically if paper documents cannot be delivered?

Yes. Our preference is that agencies utilize MainePays for this purpose to the greatest extent possible. For non-MainePays transactions, if agencies can send electronic copies of the payment documents with support in pdf or jpg format in an email, OSC will work to process them based on this documentation. It is important to include all appropriate, relevant components in your email. For transactions that we process based on emailed documents, we will still need paper documents with barcodes delivered to OSC for scanning to ensure that auditable backup is stored in DocuWare.

7. What approvals will be accepted in lieu of a wet signature?

Emails that includes approval from the agency person responsible for authorizing the expenditure and an email to OSC (can be an email chain) from the SC or Financial/Business Office supporting those approvals. The two levels of approval in Advantage will still be required.

8. What are the critical components to include in emails for payment documents and supporting approvals?

Doc ID (in Subject Line), Vendor Name and Payment Amount.

9. What if the support documentation includes PII (SSN, DOB, Confidential settlement information, etc.)?

Inform us in the email that the support includes PII that you cannot share in an email and that you will maintain the support until you are ready to provide the paper copies. OSC will continue to be available via telephone at our regular contact numbers.

10. How will documents be scanned to DocuWare when processing and approvals are supported by emails?

OSC will not send documents to DocuWare until we can print email approvals and collect all needed supporting documentation.

11. Can agencies request TR Pick up?

Effective after payment processing on Friday, March 20, 2020, TR Pickups will only be approved when there is a critical need and prior arrangements have been made with OSC and the Office of the State Treasurer (OST). OSC and OST will require comprehensive justification and will require more logistical coordination to make the check available.

Documents

1. What is the format of a Document ID?

- Document ID numbers cannot be more than 20 characters.

- They cannot include spaces or special characters.

- Any variances in the above may cause issues during the Scan Matching process. Please note that Advantage will not reject the document.

2. How do I fix an invalid Document ID that hasn't been finalized yet?

- If your document has not been approved to final, find the document in the Document Catalog.

- Check the box beside your document.

- Click on the "Copy" link.

- Create a new document with a new ID number.

- After the new document has been completed, go back and discard the incorrect document.

- Please make sure to print off a new barcode sheet.

3. How do I recall a Document from the worklist?

Recalling a document allows you to retract a document which you have previously approved as long as the document is pending approval from the next approver in the routing sequence. Recalled documents will be removed from the next approval role's worklist and returned to your worklist. If a user has moved the document to his/her personal worklist, the document is no longer available for recall. Documents in final status cannot be recalled.

- Click Message Center.

- Click Worklist.

- Your personal worklist opens; click Recall.

- Select the check box next to the document you want to recall and click Recall.

- A message appears confirming that the recall was successful.

Payments

1. What does a TR pickup mean?

TR is the flag on a document in Advantage for Treasury Pickup.

- TR pickup for a check requires prior approval by OSC before sending an over $10,000 payment document.

- TR pickup for payment documents under $10,000 also require prior approval by OSC, though the paper document is not sent.

*Also, you must be present to sign at Treasury the next day or else Treasury will mail out the payment to the vendor.

2. What do the "98" and "99" codes mean?

- "98" represents payments that require next business day processing. This code requires prior approval by OSC before sending over a payment document.

- "99" represents the normal processing time of a payment which is end of week.

3. What does priority payment processing mean?

- Priority processing is for emergency documents that absolutely must be processed overnight. These emergency documents require justification and prior approval by OSC, and if approval is given, must be placed in the Red Folder (Payments).

4. What is the normal processing time for payment documents?

- Payment documents must be received by OSC no later than 4:00pm on Wednesday afternoon. This gives OSC 48 hours to process to make the deadline.

- The exception would be in the event of a holiday or shut down. In those cases, payments must be submitted to OSC 48 hours prior to the end of the week. For example, if Friday was a holiday, payments must be at OSC by Tuesday.

5. When do checks and EFT payments process?

- Regular payments are processed on Fridays and are released on Monday mornings.

- The exception would be in the event of a holiday or shut down. In those cases, payments would be processed on the last business day of that week and released on the first business day of the following week.

- Recipients of checks or EFTs should allow 3-5 business days for receipt.

6. If my payment document says final, why didn't my payment process?

- There are several reasons why a payment might not process as intended. Some reasons are:

- The scheduled payment date is beyond or older than 30 days.

- The vendor has been put on hold.

- The bank number was not placed on all the accounting lines as it should be.

7. What should be written on invoice(s) and included in a payment document?

- Documents should include:

- Original Invoice (per Controller's Bulletin FY04-06).

- Document ID including Document Type and Agency Number (i.e. GAX 08C 20150415)

- Vendor Code - Zeros can be denoted by using an (*) asterisk (i.e. VS*632456/VC1*15236)

- Per GAAP, the invoice "Remit To" address must match Vendor address record on Advantage

- Chart of Accounts (i.e. Fund, Agency, Unit, Sub Unit, Object Code; Detail Accounting, if applicable)

- Authorized Signature and Date

- Total amount being paid (*For multiple invoices, please put total of all on the first invoice)

- Contract or Grant information (i.e. including commodity and accounting lines and whether the accounting line is being partially or final paid. For example: CL#1 AL#4; CL4 AL6 F) if applicable

- Purchase Order or Requisition, if applicable, referenced on invoice

- Any other documentation that will support the payment.

8. Do I need original signatures?

- Original signatures are required per Controller's Bulletin FY04-06.

9. When can I edit or cancel a payment document that has been processed?

Sometimes it is necessary to change document information after it has been processed. Changes can only be made to the Payment Request document before a check (AD) or electronic funds transfer (EFT) has been disbursed. Once it has been disbursed, modifications or cancellation cannot be created. Corrections will have to be completed by other means.

10. How do I create a modification to a processed payment document?

Approval levels follow the same workflow rules when you initiate document creation and submission. To create a modification document, the user opens the latest version of the document and selects the Edit button at the bottom of the page. Once all changes are made and the modification is submitted and approved, the version of the document will increment by one; the phase becomes Final. All previous versions of the document will show the phase of Historical (Final). Modifications will have the following general characteristics:

- Payment documents can only be modified before an AD or EFT is issued

- Once the original document is accepted by the system, modifications are made using the Edit Function

- Modifications made to the original document may also effect any referencing documents

- Modification to fields in the Disbursement Option section is not allowed on the document. If a modification is needed, contact OSC Accounting to change these values, which must be made on the Disbursement Request (DISRQ) page.

- Errors will be generated if a user attempts to modify a payment document that has already been disbursed.

11. When do I cancel a processed payment document?

If an AD or EFT has not been disbursed and there is a change to the vendor information or a need to remove accounting lines, then the original document should be discarded or cancelled instead of edited.

In order to cancel a document, open it and select the "Discard" button at the bottom of the screen. ![]()

This opens a new document with a Function of Cancellation. This Cancellation document needs to be validated, submitted and approved to Final in order to reverse the original posting and stop the payment from being released. Once this document has been entered you will see two documents in the document catalog, one that is New, Historical and one that is Cancellation, Final.

12. How should Freedom of Information Act (FOIA) checks be recorded for deposit in the Accounting system?

Agencies are authorized to charge fees and retain those fees in accordance with Title 1 §408-A. Fees should be deposited as a credit against the expenditure object within the fund/account that incurred the cost of retrieval, copying, or mailing. Typically, reimbursement for staff time is credited to object 3897 and other costs, such as copying, paper, postage, etc. are credited to the corresponding object codes for those items of cost.

Journals

1. What is the process for overrides?

- If a document is rejecting due to an error on credit lines, inactive units, or zero net effect on an account, a department may email OSC Accounting for approval to override the document. If approval is given, the department must include the complete journal and backup along with the bar code and a copy of the email allowing the override.

2. What is considered a priority journal?

- If an account has insufficient cash and may cause interface payments to reject, a journal may be processed as a priority if it makes the account positive. A department must email OSC Accounting to request priority processing before sending over a document.

- Month and quarter end documents are not considered a priority and should follow normal end of period processing.

3. What is the normal processing time for journals?

- Journals are processed in the order they are received. OSC has three day turnaround time to approve documents.

4. When are month end journals due?

- Month end journals are due on the third business day of the month. They must be at OSC by noon to be processed.

5. When do I process a prior year adjustment?

- Please visit the Journal Information Tab for the reference document, "Prior Year Adjustments".

6. What type of description do I need on a journal document?

- Journals should contain a clear, understandable explanation of purpose of the transaction, what gives authority for the transaction, and provides dates and document ID numbers of any transactions they are correcting.

- Justification: We need enough information so that a person with basic accounting knowledge can understand the reason for the journal. Example: "This journal moves funds from account x to account y because of incorrect coding. The incorrect coding was discovered because account x does not provide that type of service." or "This journal allocated the monthly DICAP charges as approved by the USDEP. DICAP is the department's plan to allocate indirect costs. The rate for this account is xx%."

- Please DO NOT include phrases such as "clearing up allotment" or "fixing shortfall" or anything of the like. This is not an appropriate description. Instead, if expenses/revenues are being moved legitimately, they should be identified as belonging in another account and were miscoded.

7. What type of backup do I need for a journal document?

- There needs to be proper justification and clear documentation for how the dollar amounts were calculated.

- Support includes, but not limited to;

- Calculation: We need enough information so that a person with basic accounting knowledge can understand how the journal amounts were calculated. There should be documentation attached to support the journal calculation. Please cite your data sources. (If there is an excel spreadsheet that has manipulated data, please indicate how the raw data was manipulated and to what purpose.)

- data warehouse queries,

- excel spreadsheets,

- report totals from databases,

- copies of prior referenced documents,

- emails allowing authorization between agencies for transaction, etc.

- Calculation: We need enough information so that a person with basic accounting knowledge can understand how the journal amounts were calculated. There should be documentation attached to support the journal calculation. Please cite your data sources. (If there is an excel spreadsheet that has manipulated data, please indicate how the raw data was manipulated and to what purpose.)

8. What journal type should I use?

- Please visit the Journal Information Tab for the reference document, "What Type of Journal Should I Use?".

9. Where can I find the journal template?

- Please visit the Forms Tab under the heading "Accounting" for the Journal Template.

Vendors

1. What is normal processing for vendor documents?

- Normal processing times for vendor documents is approval within 4 to 5 business days. Documents are approved in the order they are submitted to OSC. In the event of high volume or special requests, approval time may take longer. Departments should hold onto the paper documentation until the document in Advantage is final. In the event the document is rejected, the person entering may refer back to the documentation to make the necessary changes. Departments should check the document catalog in Advantage to verify that their documents are final before sending documentation to scanning.

2. What is a rush vendor approval?

- Rushed or urgent approval of vendor documents are only allowed for life or death, displacement of person or to prevent negative affect to person or the State. If any of the above apply, an email must be sent to OSC Accounting for approval.

3. What do the "VS", "VC0", "VC1" and "VC2" prefixes to vendor codes stand for?

- The VC0 prefix represents vendors created in Advantage after go-live in 2007.

- The VC1 prefix represents vendors who were converted from the former MFASIS system.

- The VC2 prefix represents vendors who are set up with the MaineCare program (MIHMS).

- The VS prefix represents vendors who have been set up using the Vendor Self-Service system.

4. Who is the user "BATCH"?

- BATCH is a code that represents documents generated electronically via interface from the Vendor Self-Service (VSS) system.

5. Who is the user "INTXHHS"?

- INTXHHS is a code that represents documents generated electronically via interface from the MIHMS (MaineCare) system (DHHS/MOLINA).

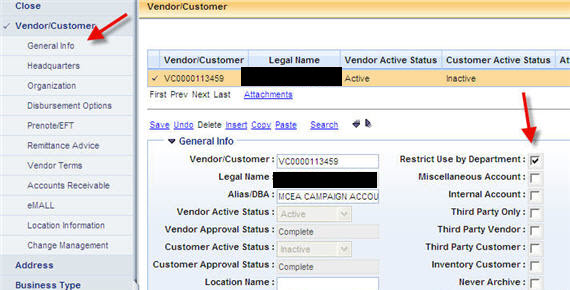

6. What does MCEA mean in the Alias/DBA field on a vendor?

- MCEA is for Maine Clean Election vendors. These vendors are restricted by department and should not be changed. If this is the only vendor code available, please create a new one.

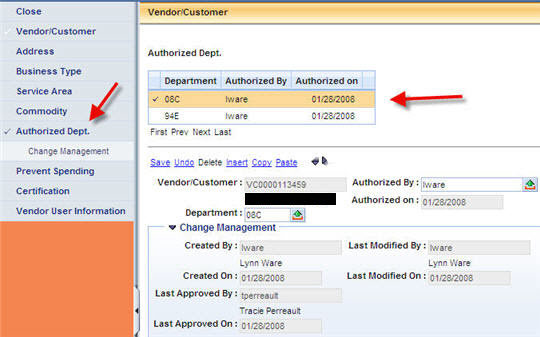

7. How do I know if a vendor is restricted to a department?

- On the VCUST table, under the Vendor Tab - General Info, there is flag for Restrict Use by Department.

- Under the Authorized Department Tab, there will be an agency/department code listed. This means that only the agency/department listed may use the vendor code. Department 08C (OSC) is included in order for checks and EFT payments to be issued.

8. What does Inactive/Reviewed status mean?

- Inactive/Reviewed status means that the current vendor record has been inactivated and placed on hold. In most cases, the vendor is no longer in use.

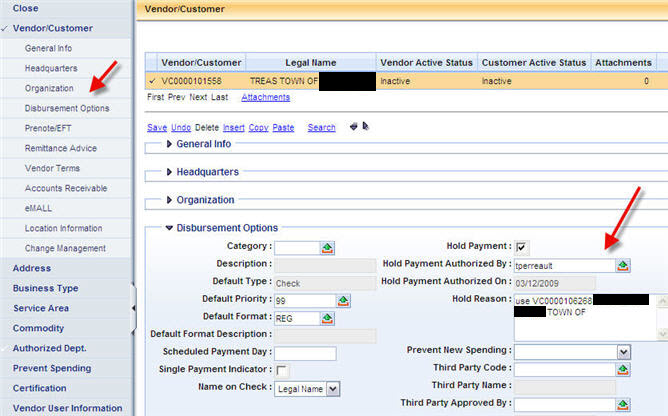

9. How do I know if a vendor is on hold?

- On the VCUST table for the vendor, under the Vendor Tab, scroll down to the "Disbursement Options" section. In the "Hold Reason" box, there will be a description listed if the vendor is on hold.

10. What is a garnishment/levy?

- A garnishment or levy is a hold on payments to a vendor due to an uncollected debt.

11. What agencies/departments can place a garnishment/levy?

- IRS - Internal Revenue Services

- MRS - Maine Revenue Services

- DOL - Department of Labor

- DHHS - Department of Health & Human Services

- OTHER

12. How do I take my account off from garnishment/levy?

- The agency/department that placed the garnishment/levy must send a release in writing to the Controller's Office. This form can either be mailed or faxed.

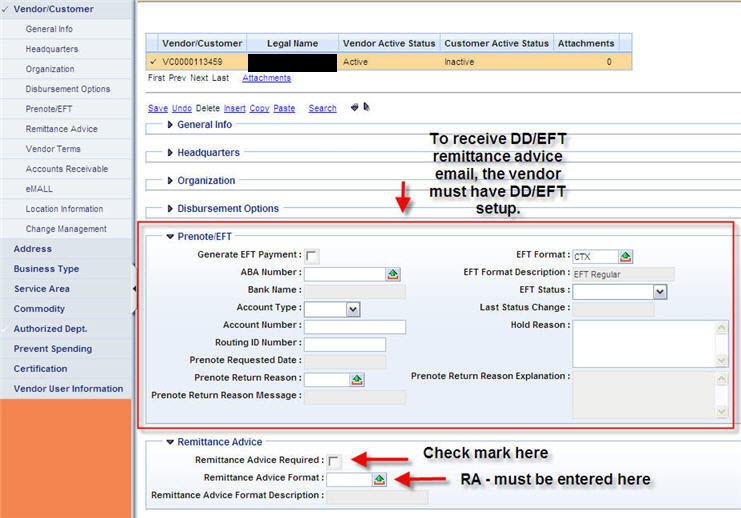

13. How do I set up my account to receive Direct Deposit/EFT?

- There are two ways to set up an account to receive electronic payments.

- The first option is to complete the Direct Deposit/EFT Activation form located on the Forms section of this website. Please complete this form and submit to OSC along with either a voided check or letter from your financial institution. Once the form is received and entered, the prenote process will take 5 business days until the account is ready to receive electronic payments.

- The second option is to contact PayMode. This is a third party organization which handles the bank account information and processes the payment information to you as a vendor. They can be reached at 1-877-443-6944.

14. How do I receive Email Notification for my payments?

- There are two ways to receive email notification.

- The first option is to contact PayMode, if you have an account already set up with them to receive notification.

- The second option is to have the Direct Deposit/EFT Activation form completed with a valid email address. The form can be located on the Forms section of this website.

15. Who do I contact about receiving remittance advices for payments from the MIHMS system?

- For information regarding the MaineCare system "MIHMS", please call 1-866-690-5585 (Molina).

16. Are original signatures required?

- All vendor forms submitted must have original signatures as the creation of a vendor is the first step in the invoice process.

17. What is policy on punctuation when entering vendors into Advantage?

- For vendor table consistency as well as IRS guidelines, punctuation should not be used when entering vendors unless using a dash (-) or ampersand (&) as part of a Legal Name.

18. How many characters are allowed for the ‘Legal Name’ and ‘Alias/DBA’ fields on the Vendor Customer table?

- Although Advantage may hold additional characters, the fields are limited to 44 characters. The reason being that the space allowed to view on a paper check is limited.

19. What is the policy on using CAPS Lock when entering vendors into Advantage?

- For consistency purposes, along with following US Postal guidelines, vendor data entry should be done using all capitalization where possible. The exception would be in the case of vendors using Vendor Self Service. VSS does not convert vendors to capital letters when loading to Advantage. In these specific circumstances, any vendor changes should follow the proper upper and lower case format.

20. What should I do if a vendor is on hold for an IRS reason, such as a TIN mismatch?

- Please reach out to OSC Accounting for further direction.

21. Is it allowable to correct a Tax Identification Number (TIN) on an existing vendor code?

- Please reach out to OSC Accounting for further direction.

More FAQs to follow.