III. Budget Monitoring and Adjustments

Adhering to the constitutional requirement of a balanced budget is both an executive and legislative responsibility. The enactment of a balanced biennial budget is necessary but not sufficient to fulfill the requirement. There are many events and conditions that can “unbalance” the budget including but not limited to: enactment of additional spending bills beyond the “budget bill”; increases or decreases in revenues collected over revenues projected; changes in need; and changes in federal funding levels.

A.Other “Spending Bills”

-

To avoid the potential of other bills creating an unbalanced General Fund or Highway Fund budget, Maine has established processes in which bills that decrease revenue or adjust appropriations, Highway Fund Allocations or Fund for a Healthy Maine allocations (also known as “spending bills”) or bills that have been identified in the fiscal note as containing an unfunded state mandate (defined in Appendix V) are, unless exempted by the Appropriations or Transportation Committee, set aside on the Special Appropriations Table or Special Highway Table. This “tabling” takes place after a bill has been enacted by the House and immediately before final enactment in the Senate. The Appropriations or Transportation Committee makes decisions on the bills on their respective tables based on available funding. Bills that remain on the table because of lack of funding may be amended to remove the provisions with fiscal impact and moved off the table or the Legislature may vote to have the bills carried over to the second session of that Legislature. Bills that are indefinitely postponed or remain on the table through inaction die when the Legislature adjourns sine die.

- Increase allotments above legislative authorization in order to spend new grant funds

- Increase allotments above legislative authorization using the unencumbered balance forward

- Increase one quarter’s spending by reducing future quarter allotments

- Transfer funds between accounts within an agency

- Transfer funds between line categories within an account

- Acting capacity appointments

- Emergency overtime for which it is impractical to budget

- Offsetting Personal Services shortfalls in other General Fund accounts that did not achieve projected vacancies

- Retroactive compensation for reclassifications or reallocations

- Retroactive or one-time settlements related to arbitrator or court decisions

- Savings within General Fund accounts may also be transferred to other General Fund accounts to cover shortfalls resulting from lower than anticipated vacancy rates but only if the savings results from higher than budgeted vacancy rates. These transfers are subject to review by the joint standing committee of the Legislature having jurisdiction over appropriations and financial affairs.

B. Revenue Shortfalls

During the thirty-three or so months between the initial preparation of the biennial budget and the end of the second fiscal year of the biennium, the Revenue Forecasting Committee may change the revenue forecast several times. A reduction in the forecasted General Fund or Highway Fund revenue may create an unbalanced budget. The Commissioner of Administrative and Financial Services is required to provide written notification to the Governor and Legislative leadership when State funds are not expected to meet the expenditures authorized by the Legislature (5

MRSA c. 142 §1533).

If the Legislature has adjourned sine die prior to the close of the fiscal year in which the deficit is projected, the commissioner may declare a budget emergency. In this case, the State Controller may transfer from the available balance in the Budget Stabilization Fund to the General Fund Unappropriated Surplus up to the amount required to match General Fund expenditures - even if that would bring the fund’s balance below the amount established by statute (5 MRSA c. 142

§1533). The Governor must immediately inform the Appropriations and Financial Affairs

Committee that such a transfer has been made.

If notification of the impending budget shortfall is provided with sufficient time to take corrective actions during a legislative session, the Governor will likely propose an emergency or supplemental budget to the Legislature. If the Legislature is not in session or there is doubt as to the ability or willingness of the Legislature to act upon an emergency or supplemental budget

bill, the Governor may temporarily curtail allotments (5 MRSA c. 149 §1668). Curtailments must be done equitably and as consistently as practicable within the original intent of the Legislature which authorized the expenditures. If such an action is taken, the Governor must immediately notify Legislative leadership.

C. Oversight of Expenditures

Appropriations and allocations are made through biennial budget bills, supplemental budgets and other spending bills and are translated into spending authority through the allotment process. Departments and agencies create annual financial plans or “work programs” based on the Legislature’s appropriations and allocations and unused balances of prior year appropriations and allocations (when specifically authorized). These work programs map the expenses of each account by quarter using the accounting system structure. They are the basis of allotments by which the State Controller authorizes expenditures. Work programs are submitted by each department and consolidated into a Financial Order. All Financial Orders, including the initial work plan, must be approved by the Governor and reviewed by the committee having jurisdiction over appropriations and financial affairs. (3 MRSA c. 24 §522)

Financial Orders, in addition to authorizing the initial work programs, allow the executive branch a certain level of flexibility in managing the appropriations and allocations efficiently and effectively while allowing the Legislative branch to fulfill its oversight duties. They are the mechanisms for transfers to:

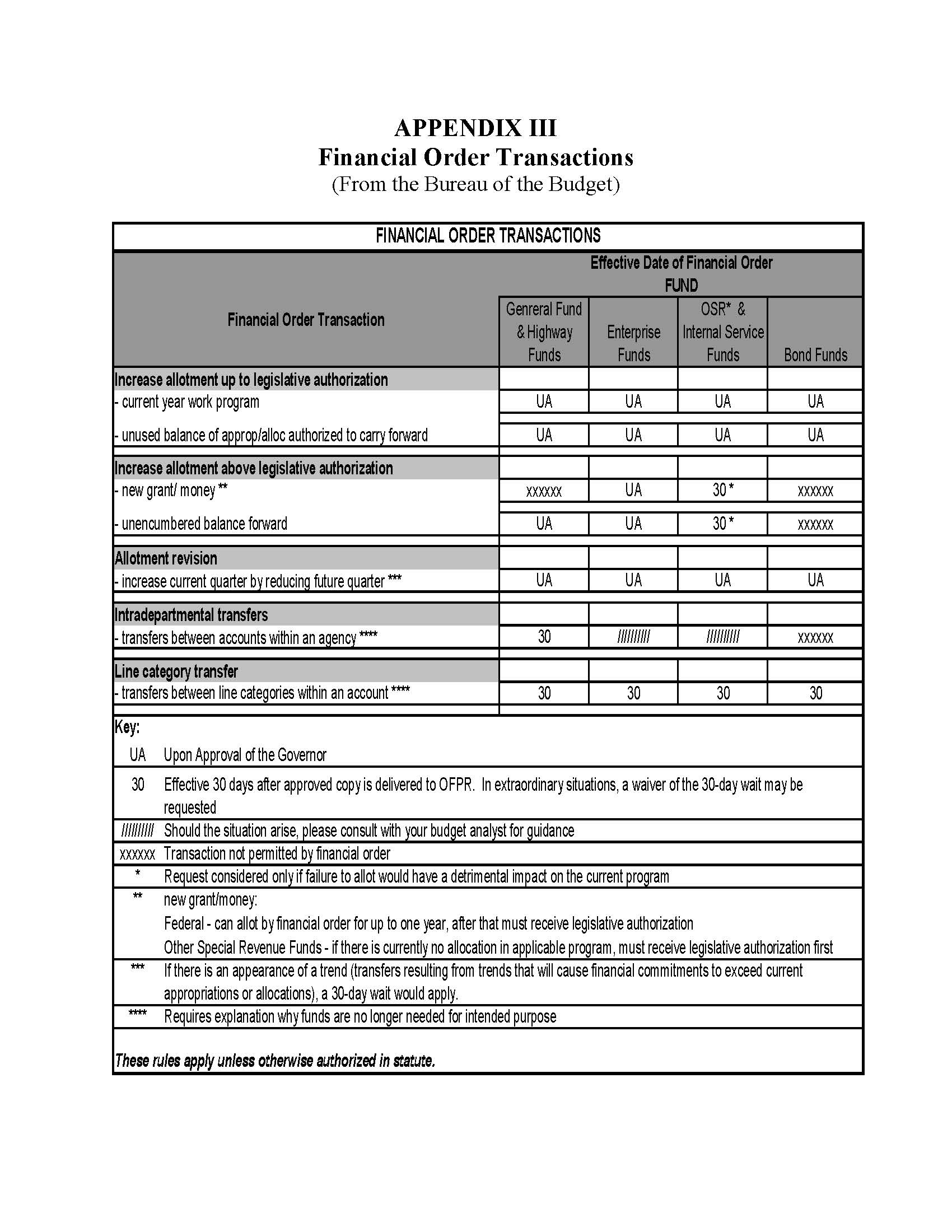

In some cases, the requesting department or agency must wait thirty days prior to implementing the Financial Order. In other cases the order becomes effective upon approval by the Governor. Orders that would normally require a thirty day waiting period can, in an emergency, become effective sooner by a majority vote of the Committee on Appropriations and Financial Affairs. (See Appendix IV for more information on waiting periods by type of Financial Order and affected fund.)

Review of Financial Orders is one of the key mechanisms available to the Appropriations Committee to monitor the spending plans of the Executive and Judicial branches to ensure that they are in accordance with the budget and other spending bills. Such a review may alert the legislature, via the Committee on Appropriations and Financial Affairs, to any significant deviations from the original work plans and the intent of the Legislature.

APPENDIX I Debt

Bonds issued by the State that carry the full faith and credit of the State are General Obligation (G.O.) Bonds. They are typically issued by the Treasurer of State and pledge the full taxing capability of the State to the payment of principal and interest. G.O. bonds must first be authorized by two-thirds of both the Senate and the House of Representatives, followed by ratification by the voters at a general or special election. An authorization allows bonds to be issued anytime within five years of its effective date. Bonds are only issued when expenditures for an authorized project are ready to be made, assuring that bond proceeds do not reside unspent in accounts for long periods of time in violation of federal arbitrage procedures. G.O. bonds may only provide funding for capital improvements and other projects that promote the general welfare of the citizens of the State such as highway construction, environmental projects, economic development, research projects, etc. They are usually tax-exempt unless there is a private use component of a project that requires the bonds to be issued as taxable bonds. Debt service can be paid by either the General Fund or the Highway Fund as specified in the implementing legislation that sent the bond issue to referendum. Article V, Part Third, Section 5 of the Constitution of Maine requires the Legislature to appropriate sufficient funds to pay the debt service on G.O. bonds and authorizes the Treasurer of State to use General Fund revenues if appropriations are insufficient. That same section of the Constitution prohibits the use of proceeds from the sale of bonds to fund current expenditures.

There are no limitations on the amount of G.O. debt that may be issued if ratified by the voters. In addition, the Constitution of Maine allows for certain limited borrowings that are not required to be ratified by the voters. These include the following under Article IX, Section 14: $90,000,000 to insure certain commercial loans; $6,000,000 to insure revenue bonds of the Maine School Building Authority (statutory authority repealed by P.L. 1993, c. 494); $1,000,000 to insure mortgage loans for student housing; and $4,000,000 to insure Maine Veterans’ Mortgage Loans. Article VIII, Part First, Section 2 of the Constitution of Maine also allows $4,000,000 for loans to Maine students in higher education and their parents.

Each of Maine’s G.O. bond issues are evaluated by at least one of the major credit rating agencies just before pricing of the bonds. The ratings provide an estimate to potential investors and others of the ability of the State to pay back the interest and principal of any bonds being issued. They are a measure of risk and help bidders decide how much they will require in interest to purchase Maine bonds and are, therefore, a factor in determining the cost to the State to issue bonds. The rating agencies look at the State’s budgeted revenues and expenditures, the amount of debt already obligated and expectations for the Maine economy going forward. The value of any one-time funds used to off-set ongoing expenditures may be discounted by the rating agencies as those funds would not be available over the life of the bonds.

State law (5 MRSA §150) authorizes the Treasurer of State to enter into certain temporary loan agreements in anticipation of revenues. The Treasurer of State, with the approval of the Governor, may negotiate temporary loans in anticipation of taxes levied for that fiscal year. Each loan must be retired no later than the close of the fiscal year in which the loan was originally made. PL 2001, c. 705 amended previous statutory limits on these loans to set the annual limit at the constitutional level, which is the lesser of 10% of total General Fund appropriations and total Highway Fund allocations or 1% of the total valuation of the State of Maine. These loan agreements are known as Tax Anticipation Notes (TAN’s).

State law (5 MRSA §150) also authorizes the Treasurer of State, with the approval of the Governor, to enter into certain temporary loan agreements in anticipation of receipt of proceeds from the issuance of bonds authorized but not yet issued. The statue requires the loans to be repaid from the proceeds of bonds within one year from the date of the loan but, in practice, they are repaid within the same fiscal year to avoid conflict with the State Constitution.

Maine Governmental Facilities Authority

-

The Maine Governmental Facilities Authority is authorized to issue up to $263,485,000 in securities to fund construction-related projects for state agencies or court facilities. Of that amount, $85,000,000 is authorized for correctional facilities; $53,000,000 is authorized for the State House, State Office Buildings and other agency projects; $33,000,000 is authorized for a new psychiatric treatment facility; $76,000,000 is authorized for court facilities; and $16,485,000 is authorized for capital repairs and improvements at state facilities.

APPENDIX II

How Positions Are Created, Budgeted And Managed

-

Issues related to state employees, including their number, compensation, and funding are often in the forefront of budget deliberations. Personal Services (wages, benefits and payroll taxes) amount to over 12% of the General Fund budget and the number of authorized positions is the biggest driver of that category. The State’s budget process results in the specific authorized headcount.

-

Headcount as it appears in the budget bill and in many other spending bills falls under one of two headings: Legislative positions and Full-Time-Equivalent (FTE) positions. Legislative positions are established without an end-date on a full year basis. These may be full-time or part-time and are assigned a legislative position count of 1.00 or .500 respectively. FTE positions are also established without an end date but on a partial-year basis (less than 52 weeks). The FTE positions are assigned a count by dividing the number of hours the employee is expected to work during the year by 2,080 (the number of hours budgeted for full-time employees for a full year). The Executive Branch may, by financial order, establish limited-period positions (including workers compensation positions and all positions paid for through non-state funds), project positions or other temporary positions for a period not to exceed two years. The Legislature must specifically appropriate or allocate funds for continuance of these positions (MRSA 5 § 1583-A). Positions authorized solely by financial order are not included in Legislative or Full-Time Equivalent counts but the associated expenses are included in the Personal Services category.

Personal Services Expenditures

The amount budgeted for total salaries and wages for all authorized and funded positions is reduced by a predetermined amount to account for attrition. In some instances, there may be additional salary savings generated from vacant, but funded, positions or for other reasons such as filling vacant positions with employees at a lower salary grade than the prior incumbent. Such savings may be used within the same account to pay for nonrecurring Personal Services costs such as:

-

Permanent positions for which funds are appropriated or allocated must be classified positions (subject to the civil service system) unless specifically designated otherwise by the Legislature. Each classified position has a set of specific characteristics. Jobs that have similar work and responsibilities are grouped and assigned to a common job classification and salary grade. Some position classifications have only a few employees because of the uniqueness of the duties, while others have hundreds of employees because the general duties are very similar from one agency to another. It is the responsibility of the Director of the Bureau of Human Resources within the Department of Administrative and Financial Services to ensure that classified and unclassified positions are assigned to the proper pay grade and of the State Budget Officer to ensure that the positions are within authorized headcount and funds.

A position reclassification occurs when an employee is performing duties outside of his or her assigned position classification. A reclassification may be initiated by an employee or management via a Functional Job Analysis (FJA) form. The Bureau of Human Resources determines whether a reclassification is warranted and, if so, identifies the appropriate classification. Collective bargaining agreements obligate the State to honor approved reclassifications. If the reclassification was initiated by the employee, the effective date is the date that he or she signed the FJA and funding must be identified for a retroactive adjustment. If the reclassification was initiated by management, it is effective upon funding. In either case the reclassification will not be released by the Bureau of the Budget until funding is achieved.

Funding for the on-going costs of the reclassification may be achieved either through the legislative process or through identified permanent savings within the Personal Services line category in the same account (or accounts) in which the classified position is budgeted. Sources of permanent savings include eliminating a position, exchanging a position for one of a lower classification, or reducing the hours or weeks of a position. If a reclassification results in retroactive costs, funding for that portion must be found; generally through salary savings in the same account engendered from vacancies in excess of the assumed attrition rate.

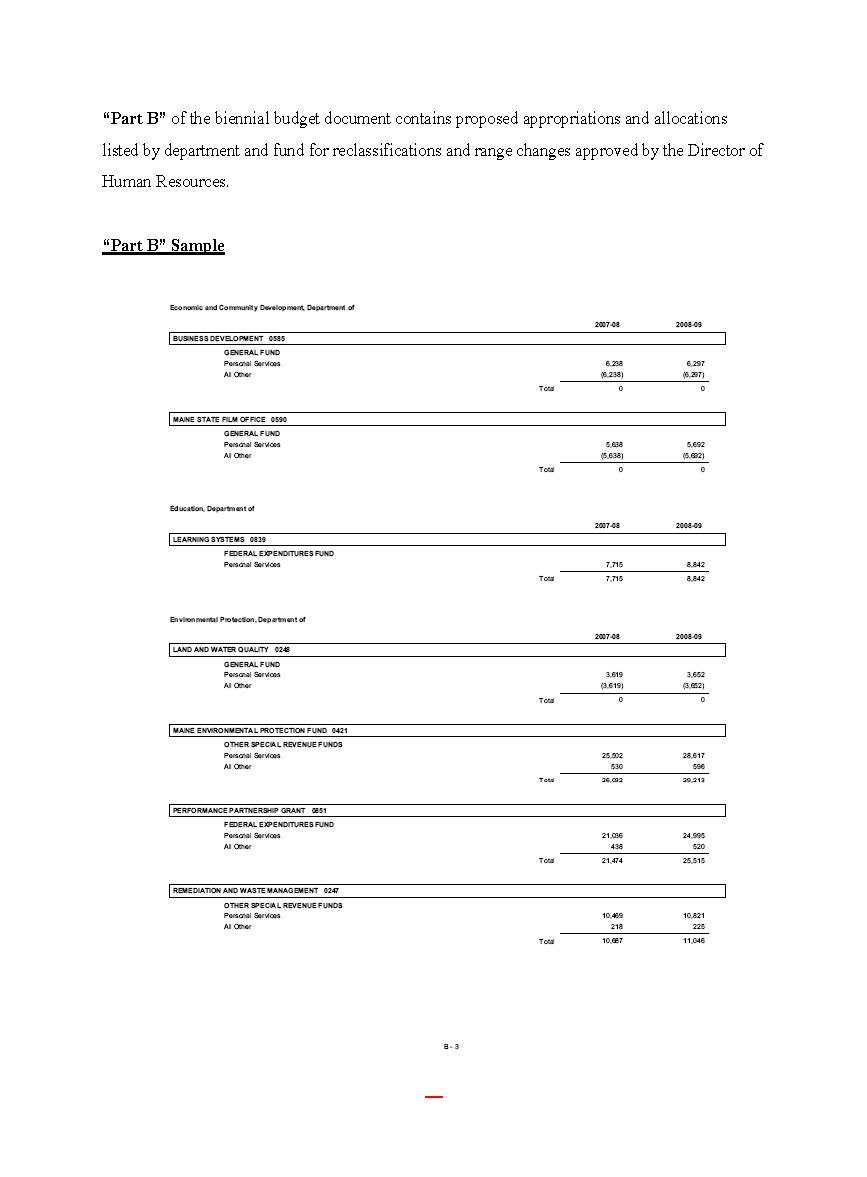

Funding for an approved reclassification requires legislative approval if the offsetting savings can only be identified from another account or if an appropriation or allocation is required because no savings can be identified. The mechanism for requesting self-funded appropriations or allocations for the General Fund and Highway Fund and for all other funds for which additional revenue can be identified is, typically, Part B of the budget bills submitted by the Governor. If the reclassification requires a General Fund appropriation or a Highway Fund allocation because the department cannot self-fund or revenue for reclassifications affecting other funds cannot be found, the request for reclassification would be included as a Part A initiative in the budget bill.

Reorganizations differ from reclassifications in that the department or agency proposes a change in the duties of a position, often in conjunction with a reorganization of one of its units. The duties of the new classification are not assigned to the position until the department or agency receives approval and an effective date from the Bureau of the Budget. The proposed reorganization is not retroactive and is not implemented until funding is identified. If permanent funding cannot be found from the sources described in the above section, a request may be made in the form of an initiative in Part A of the budget bill.

APPENDIX III Financial Order Transactions (From the Bureau of the Budget)

APPENDIX IV Sample Budget Proposal

-

This sample is taken from the Governor’s “Recommended 2008-2009 Biennial Budget”. The format of the document as it relates to the various parts conforms to recommendations of the Commission to Reform the State Budget Process. The recommendations of the commission relating to the form and content of the state budget document are contained in 5 MRSA §1664. The recommendations on how the “baseline” revenues and expenses, proposed changes to the baseline and approved position classifications should be itemized were not included in statute.

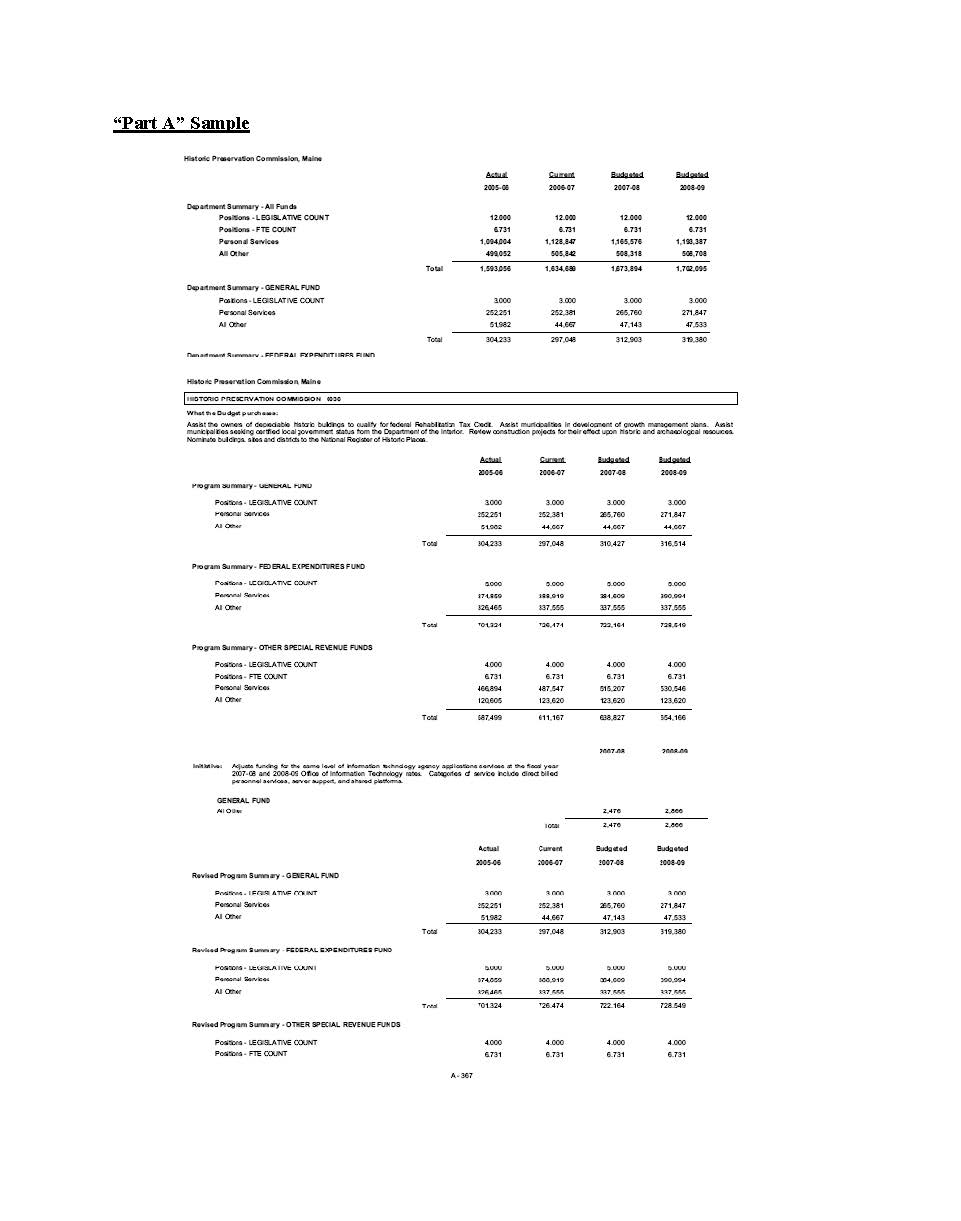

“Part A” of the biennial budget document begins with a Department Summary listing all sources of funding, by line category, for each department included in the bill (biennial budget documents include all programs and departments, other budget bills include only those with proposed changes). Following the Department Summary is a Program Summary sorted alphabetically by program title. Within each program there is a short narrative entitled: What the Budget Purchases describing its activities. The Program Summary section lists the appropriations for the prior fiscal year, current fiscal year and the two budgeted fiscal years. (Note: Prior year revenue and expense columns are removed when the budget document is translated into a bill.). The budgeted amounts reflect what is known as the baseline budget. In this part of the budget, Positions listed in budgeted years do not deviate from those currently authorized by the legislature, the amounts for Personal Services are adjusted to reflect projected increases for benefits and special payments and the amounts budgeted under All Other equal the amount appropriated or allocated for the current fiscal year less any amount not considered on-going. Proposed reductions or additions to the baseline budget or proposals to create new programs or modify existing programs are listed as Initiatives. The Revised Program Summary reflects the net effect of all Part A initiatives on the baseline budget for all funding sources and all line categories.

"Part A" Sample

“Part B” of the biennial budget document contains proposed appropriations and allocations listed by department and fund for reclassifications and range changes approved by the Director of Human Resources.

“Part B” Sample

APPENDIX V

Selected Budget Terms And Definitions

Adjustments to Balances/Transfers Transactions reflecting the transfer of balances or reserves based on revenue or resources earned in a prior fiscal year. These transactions include the transfer to or from reserve funds, the lapsing of carrying balances and the transfer of balances between funds. Most of these transactions are specific one-time authorizations. Fiscal notes segregate and report these changes to available resources separately from revenue items, which are earned and adjusted or transferred in the current fiscal year. In addition to the budgeted Adjustments to Balance/Transfers, the Office of the State Controller records other prior period adjustments that affect balance throughout the fiscal year as unbudgeted events. These unbudgeted adjustments increase or decrease available fund balances, but do not affect revenue or expenditures.

All Other See Line Category

Allocation The amount of expenditures authorized by the Legislature from resources legally restricted or otherwise designated for specific operating purposes. All non-General Fund resources are “allocated”. The Legislature allocates to programs (e.g. Bureau of Insurance) and line categories (i.e. Personal Services, All Other, Capital or unallocated). Negative allocations are called deallocations.

Allotment The designation of a department or agency’s estimated expenditures in each fiscal year budget (called the annual work program) by quarter and line category. Four quarters are used each fiscal year. The approved amounts are recorded in the accounting general ledger by quarter and line category to form the basis on which the State Controller authorizes expenditures, in accordance with statute.

Appropriation The amount of expenditures authorized by the Legislature from unrestricted or undesignated resources for specific operating purposes. All General Fund resources are “appropriated”. The Legislature appropriates to programs (e.g. General Purpose Aid to Local Schools) and line categories (i.e. Personal Services, All Other, Capital or unallocated). Negative appropriations are called deappropriations.

Appropriations Table, Special A process by which most bills affecting General Fund revenue or requiring an appropriation from the General Fund are postponed prior to enactment in the Senate pending review by the Committee on Appropriations and Financial Affairs. In the closing days of the session, the committee recommends passage, amendment or defeat of those bills. Bills on the Special Appropriations Table are listed on the Senate Calendar.

Arbitrage The nearly simultaneous purchase and sale of securities or foreign exchange in different markets in order to profit from price discrepancies. In Maine’s debt service context, a violation of IRS federal arbitrage rules is defined as any action that has an effect of enabling the state to exploit the difference between tax-exempt and taxable interest rates to obtain a material financial advantage and overburdening the tax-exempt bond market (e.g. issuing tax-exempt bonds and investing the proceeds as opposed to using them for the authorized purpose).

Attrition A factor applied against budgeted state employee salary amounts which reduce budget requests for Personal Services to account for projected personnel turnover.

Baseline Budget The starting point for a program’s appropriation or allocation in the upcoming biennium. Personal Services funding is based on the projected salary and fringe benefit costs of authorized positions. All Other funding is based on the current fiscal year adjusted for any one-time initiatives. No Capital Expenditures are included in the baseline budget.

Biennial Budget The two-year financial plan which shows the estimated expenditures of the various departments and agencies of Maine State Government and the resources available (or proposed to be available) to fund them.

Biennium The two fiscal years that represent the period covered by the State’s biennial budget (e.g. the 2014-2015 Biennium begins July 1, 2013). The convention used to refer to a biennium is to use the hyphen between the calendar years in which each of the fiscal years end.

Bond Anticipation Note (BAN) Short-term notes (12 months or less) used to meet capital project needs that are supported by General Obligation Debt. This short-term borrowing is used to avoid piecemeal debt issues and thus minimize debt issuance costs and reduce the risk of violating federal arbitrage rules. The proceeds from the annual General Obligation Bond issuance are used to pay off the principal due on the BAN.

Bond Issue A financing instrument for major capital purchases, projects, repairs, renovations or other limited projects by which the State incurs debt and retires the principal and interest amounts over time.

Budget Bills Legislative documents, almost always submitted by the Governor, that seek appropriations, allocations and/or revenue adjustments to finance Maine State Government and other public purposes and may seek statutory or other unallocated language to implement fiscal policy. Included are:

“Emergency” – proposals in the First Regular Session to resolve budget issues for the current fiscal year.

“Biennial Budget Bill” – proposals in the First Regular Session to resolve budget issues for the upcoming biennium which reflect both the baseline budget (see above), adjustments to existing initiatives, expansion of the scope of an initiative or an initiative of an organizational nature for the upcoming biennium.

“Supplemental” – proposals in the Second Regular Session or a Special Session to resolve budget issues for the balance of the current biennium.

Budgeted Ending Balance The uncommitted balance of a fund at the close of a fiscal year. This term is commonly used in reference to the General Fund and Highway Fund and is simply stated as follows:

Budgeted Net Transfers and Adjustments plus Budgeted Undedicated Revenue less Budgeted Authorized Expenditures (i.e. appropriations or allocations) plus the beginning balance.

Budget Initiatives Proposal for reductions or adjustments to the baseline budget or proposals to create new programs or modify an existing program. Initiatives are included in Part A of the budget document and must be accompanied by a description of the intent of the initiative or the specific action to be taken.

Budget Order An administrative document prepared by various departments and agencies to transfer allotment reserve (i.e. unspent and unencumbered allotment from a previous fiscal quarter) from the reserve to a current quarter. These transfers must be authorized by the State Budget Officer.

Budget Stabilization Fund A General Fund program to reserve funds to offset General Fund revenue shortfalls. The fund is capped at 12% of the General Fund revenue in the immediately preceding fiscal year.

Capital Expenditures See Line Category

Capital Projects Fund A governmental fund established to receive and disburse money from the sale of general obligation bonds. Separate funds exist to accommodate proceeds from General Fund bonds, Highway Fund bonds and Self-liquidating bonds. Disbursements cannot be made from these funds for current expenditures but must be for buildings, equipment, roads, infrastructure, technology and other purposes considered capital projects.

Cascade (so-called) A Legislative authorization transferring amounts, if available, from the Unappropriated Surplus of the General Fund at the close of the fiscal year after all statutory transfers and financial commitments determined necessary by the State Controller have been satisfied. The amounts transferred are generally added to the program’s appropriation in the following year. Typically, a priority is established for the transfers.

Cash Pool Conduit through which all checks, cash, wire transfers, electronic funds transfers and bank credits of any kind collected by any and all State of Maine agencies are aggregated, accounted for and disbursed. Any funds in the Cash Pool not needed immediately for disbursements are invested by the Treasurer. Earnings are distributed based on the average daily balance of each account specifically authorized by statute.

Certificates of Participation (COP) A lease financing agreement in which the State encumbers some portion of its revenue base over an extended period of time to repay debt for a capital project. Authorization does not require voter approval.

Contingent Account, State A General Fund Program established for use by the Governor as he or she deems it necessary for specified purposes up to specific expenditure caps as described in 5 MRSA §1507.

Deallocation A negative Allocation (see “Allocation” definition,) reducing spending authority.

Deappropriation A negative Appropriation (see “Appropriation” definition) reducing spending authority.

Debt Service Principal and interest paid or estimated to be paid on outstanding borrowed funds.

Debt Service Earnings Investment earnings on issued debt but unpaid for authorized projects. These investment earnings are managed within federal arbitrage rules and are used to reduce the amount that would otherwise be appropriated or allocated each fiscal year for General Obligation Debt Services.

Dedicated Revenue Revenue accruing to a department or agency for use toward designated or legally-restricted operational purposes.

Departmental Indirect Cost Allocation Plan (or DICAP) A charge to other than general fund appropriation accounts using a percentage assessment against actual expenditures representing the proportional value of indirect benefits received within the department or agency. It is generally prepared annually by a state agency and approved by the cost negotiating unit to which the state reports for its federal programs. The plan identifies the rates that the agency may assess for certain centrally provided services (e.g. payroll, human resources, office space, accounting, etc.) for which the federal program is not directly paying.

Encumbered Balance Forward The balance of funds in an account which is reserved for the future liquidation of encumbered purchase orders and contracts and which carries forward from one fiscal year to the next in accordance with law. Encumbered balances at year-end carry forward only one year unless stated otherwise in law.

Encumbrance A commitment against allotment for legally binding purchase orders and contracts representing goods and services which have not yet been received. Encumbrances become expenditures and liabilities only when the goods and services are actually received.

Enterprise Fund A proprietary fund in which goods and services are provided by a state department or agency to the general public through charges based on consumption. Such fund types may or may not be self-sustaining depending upon the cost structure of the agency whereby cost of goods sold, debt interest and other non-operating expenditures are deducted from gross revenue to determine the entity’s net income or loss for the fiscal year.

Federal Medical Assistance Percentage (FMAP) The percent of total Medicaid costs supported by the federal government. Published annually in the Federal Register, it is computed from a formula that takes into account the average per capita income for each State relative to the national average. A “blended rate” is often used for budgeting purposes to adjust for the fact that Maine has a different fiscal year than the federal government.

Federal Financial Participation (FFP) The amount of money received by a state from the federal government for programs that are supported with both state and federal funds. The amount of FFP available for the Medicaid program is determined to a large extent by the applicable FMAP. FFP is also available for the cost of administering the Medicaid program, generally calculated as 50% of allowable costs.

Financial Order A legal document used by a department or agency to establish allotment, revise allotment, increase allotment, transfer funds between accounts within the same department and/or agency and fund type, transfer funds between line categories in the same account, or to accomplish any other related legal action upon the approval of the Governor.

Fiscal Note A qualitative or quantitative statement issued by the Office of Fiscal and Program Review describing the fiscal impact of a bill or an amendment; or that part of a Legislative Document (LD) containing the same information (as required by the joint rules of the Legislature).

Fiscal Year (Federal) The legal accounting and budgetary cycle of the Federal Government covering the period of October 1 through September 30. The fiscal year is commonly referred to by including the calendar year in which the fiscal year ends (e.g. FY 13).

Fiscal Year (State) The legal accounting and budgetary cycle of Maine State Government covering the period of July 1 through June 30 (5 MRSA, §1501). The fiscal year is commonly referred to by including the two calendar years involved (e.g. FY 2012-13), or more commonly, by including the calendar year in which the fiscal year ends (e.g. FY 13).

Full Time Equivalent (FTE) Used to describe positions of less than 52 weeks in a fiscal year as authorized by the Legislature. FTE positions are assigned a count by dividing the number of hours the employee is authorized to work during the year by 2,080 (the number of hours budgeted for full-time employees for a full year).

Fund A fiscal and accounting entity with a self-balancing set of accounts showing cash and other financial resources, together with all related liabilities and residual equities or balances, and changes therein, which are segregated for the purpose of carrying on specific activities or attaining certain objectives in accordance with special regulations, restrictions, or limitations.

General Fund The primary operating fund of Maine State Government. It receives revenue from general state revenue sources (Individual Income Tax, Sales and Use Tax, Corporate Income Tax and Cigarette Tax).

General Obligation Bonds (aka GO Bonds or Debt) A General Fund or Highway Fund bond issue in which the full faith and credit of the State is pledged to repay.

GPA Refers to the General Purpose Aid for Local Schools program within the Department of Education and funds the State’s share of K-12 public education.

GARVEE Bonds (Grant Anticipation Revenue Vehicle) A transportation-financing instrument. The principal amount borrowed may not exceed 50% of transportation funds appropriated by the Federal Government in the prior federal fiscal year. The principal and interest amounts of these bonds are to be repaid within 12 months with federal highway funds.

Highway Table, Special A process by which most bills affecting Highway Fund revenue or requiring an allocation from the Highway Fund are postponed prior to enactment in the Senate pending review by the Transportation Committee. In the closing days of the session, the committee recommends passage, amendment or defeat of those bills. Bills on the Special Highway Table are listed on the Senate Calendar.

Indirect Cost A cost, such as general administrative (human resources and accounting), maintenance and utility expense, that is incurred but cannot be directly allocated in full to a particular service, cost center or business activity. A cost may be incurred on behalf of a number of cost units or centers to which the cost may be apportioned through an allocation process/indirect cost rate.

Internal Service Fund A self-sustaining, proprietary fund which derives its resources in support of expenditures from service charges to other state departments and agencies and other units of government.

Lapsed Funds Uncommitted funds remaining in an appropriation account at the close of a fiscal year which are returned to the fund from which they were originally appropriated or allocated by the Legislature.

Legislative Count See “Position” definition.

Line Category Expenditure groups to which the Legislature appropriates and allocates funds:

“Personal Services” – includes state employee salaries and benefits, and certain per diem expenditures.

“All Other” – includes all non-personal services expenditures such as general operating expenses, grants, travel, etc., excluding items meeting capital expenditures criteria (see below).

“Capital Expenditures” – includes expenditures for real property, fixed assets with a unit cost of $5,000 or more and/or a certain useful life, construction and certain repairs.

“Unallocated” – undesignated allocations, which must be transferred to another line category prior to being authorized for expenditure.

Mandate, State An action by the State that requires a local unit of government to expand or modify its activities so as to necessitate expenditures of additional local revenues.

MAP Refers to the medical assistance payments within the Medical Care - Payments to Providers program within the Department of Health and Human Services and provides the largest portion of the funding for the state-federal Medicaid program (called MaineCare in Maine).

Moral Obligation Bonds Bonds issued by an instrumentality of the State (e.g. FAME, University of Maine System, Maine State Housing Authority etc.) for which the State does not pledge its full faith and credit to repay. Statutory authority is required for the instrumentality to issue these bonds.

NF (pronounced "NiF") Refers to the Nursing Facilities program within the Department of Health and Human Services.

Personal Services See Line Category

Position A job in a state department or agency that has been authorized by the Legislature. Position headcount may be established without an end-date on a full-year basis (Legislative Count) or on a partial-year basis (Full Time Equivalent). If the end-date is known, positions are established without headcount on a project, temporary or limited-period basis.

Position Reclassification An action taken by a department or agency when it is determined that an individual assigned to a particular position is working out of the classification of that position because of duties assigned. An employee can initiate the steps needed for this action to occur. The effective date of the reclassification is the earliest initiated date of the action.

Position Reorganization An action taken by a department or agency when it decides to reorganize the duties of a position to the extent that a change to the classification of the position may be necessary. The reorganization becomes effective when permanent salary savings are identified.

Program A grouping of activities and expected results that are directed toward the accomplishment of a set of goals and objectives consistent with statutorily defined missions and represents a department bureau, division or operational entity to which the Legislature appropriates or allocates resources defined by the Legislature.

Salary Plan Accounts in the General Fund and Highway Fund to which funds are appropriated or allocated by the Legislature to meet the economic costs of state collective bargaining agreements. Transfers to department or agency General Fund or Highway Fund accounts normally are accomplished in the fourth quarter of a fiscal year after a determination of the actual salary needs of a department or agency and upon the recommendation of the State Budget Officer and the approval of the Governor.

Sine Die Without a day specified for a future meeting; indefinitely.

Statewide Cost Allocation Plan (STA-CAP) A charge to Federal Expenditures Fund, Federal Block Grant Fund, Other Special Revenue Funds or other fund accounts using a percentage assessment against the aggregate of monthly actual expenditures for each class and object from 3110 through 5999. It is prepared annually by the Office of State Controller and approved by the cost-negotiating unit of the U.S. Department of Health and Human Services. The plan identifies the rates that the State may assess for certain centrally provided services paid for through General Funds (e.g. payroll, human resources, office space, security, etc.). A rate that reflects the specific services utilized is calculated for each department and unit of state government regardless of the funding sources of the departments’ and units’ programs. The calculated rate is applied against all eligible expenditures (grants and capital expenditures are excluded) of the non-General Fund accounts (e.g. federal funds, State Other Special Revenue funds, etc.).

Strategic Plan A long-range, policy-oriented document that maps an explicit plan between the present and a vision of the future. A strategic plan is derived from an assessment, goal-setting, and decision-making process that relies on careful consideration of an agency’s capabilities and environment. A strategic plan identifies a state agency’s mission, goals, measurable objectives, and strategies and leads to priority-based resource allocation and other decisions (see 5 MRSA c. 151-C). Sunset date was at the end of FY 07 (see Performance Budgeting above).

Structural Surplus (Gap) Defined by the Legislative Office of Fiscal and Program Review as the difference between the projected General Fund (or Highway Fund) revenue estimated to be collected in the upcoming biennium based on current law and economic projections and the projected General Fund appropriations (or Highway Fund allocations) that are needed to maintain the current level of legislatively-approved or funded program effort for that same period of time.

Supplemental Budget Proposals Bills submitted to resolve budget issues for the balance of the current biennium.

Tax Supported Debt Debt obligation of a State agency or the Maine Governmental Facilities Authority (MGFA). The debt service may be paid from General Fund or Highway Fund undedicated revenues. The debt obligations may include General Obligation Debt, Certificates of Participation, Lease Financing Agreements and debt incurred by MGFA

Trust Fund An account established to hold permanent funds received by the State for specific long-term purposes. Trust funds are managed by the Treasurer of State.

Unallocated See Line Category

Unappropriated Surplus An account maintained by the State Controller to include the balances not otherwise committed by law or designated by the State Controller as required according to Generally Accepted Accounting Principles. (See 5 MRSA §1544).

Undedicated Revenue Revenue collected by a department or agency but which accrues to a general ledger account for use toward undesignated or unrestricted operational purposes.

Unencumbered Balance Forward The balance of funds in an account which is not restricted or reserved with respect to their availability for future use and which carries forward from one fiscal year to the next by line category in accordance with law.

Unfunded Actuarial Liability (UAL) The liability the State of Maine has with regard to the State Employee and Teacher retirement plan of the Maine State Retirement System. The unfunded liability is the total of the actuarial liability for all members less the actuarial value of the Retirement System’s assets.

Work Program The fiscal year financial plan or budget plan of a department or agency showing all revenues or other resources along with estimated expenditures by account, line category, quarter and class and/or object.

Year-End Statutory Transfers Transfers from the Unappropriated Surplus of the General Fund authorized by statute. Specific transfers are often added or amended for specified fiscal years or under specified conditions.

Up to $350,000 to the State Contingent Account (5 MRSA §1507);

Up to $1,000,000 to the Loan Insurance Reserve Fund (5 MRSA §1511) [max. of $35M];

Up to $15,000,000 per year to a reserve account to fund retirement payments for retired state employees and teachers in fiscal years ending June 30, 2012, June 30, 2013 and June 30, 2014 only (5 MRSA §1522)

35% to the Budget Stabilization Fund [max. of 12% of actual GF revenue of the year being closed] (5 MRSA §1532);

20% to the Retirement Allowance Fund (5 MRSA §17251);

20% to the Reserve for General Fund Operating Capital (5 MRSA §1511) [max. of $50M];

15% to the Retiree Health Internal Service Fund (5 MRSA §1519) and

10% to the Capital Construction & Improvements Reserve Fund (5 MRSA §1516-A).